About the broker

Ex-Cap is an online brokerage specializing in crypto-denominated instruments. This brand claims that its customers can trade the world’s largest markets with crypto without having to worry about conversion rates. With support for crypto deposits and withdrawals, it looks like the solution can be of great use for digital asset holders.

Because trading conditions seem appropriate, our Ex-Cap review will analyze the asset coverage, account opening process, and, most importantly, regulatory compliance. All of these are critical factors to consider before starting to trade with a new broker.

Crypto-denominated instruments (CDIs)

Compared to the majority of brands out there providing tradable assets denominated in fiat currencies, Ex-Cap brings in a new vision. In this case, you can access hundreds of CDIs (crypto-denominated instruments) without selling your cryptocurrencies.

Traditionally, as a cryptocurrency holder, you had to sell coins, transfer fiat to a bank account and only then proceed to fund a live trading account. All of these steps involve particular costs with an impact on your bottom line.

With Ex-Cap that’s no longer the case since these instruments are not just related to the crypto space. Even FX, stocks, indices and commodities are available with the broker, priced in digital assets. As usual, you can trade on margin with flexible leverage up to 1:200, depending on the asset class.

Fast account opening

Another benefit of the brand is that it works for a global audience, not just a specific niche of experienced traders. Even if you don’t already know what CDIs are, that’s not an issue, because opening an account is simple and the company explains everything on its website.

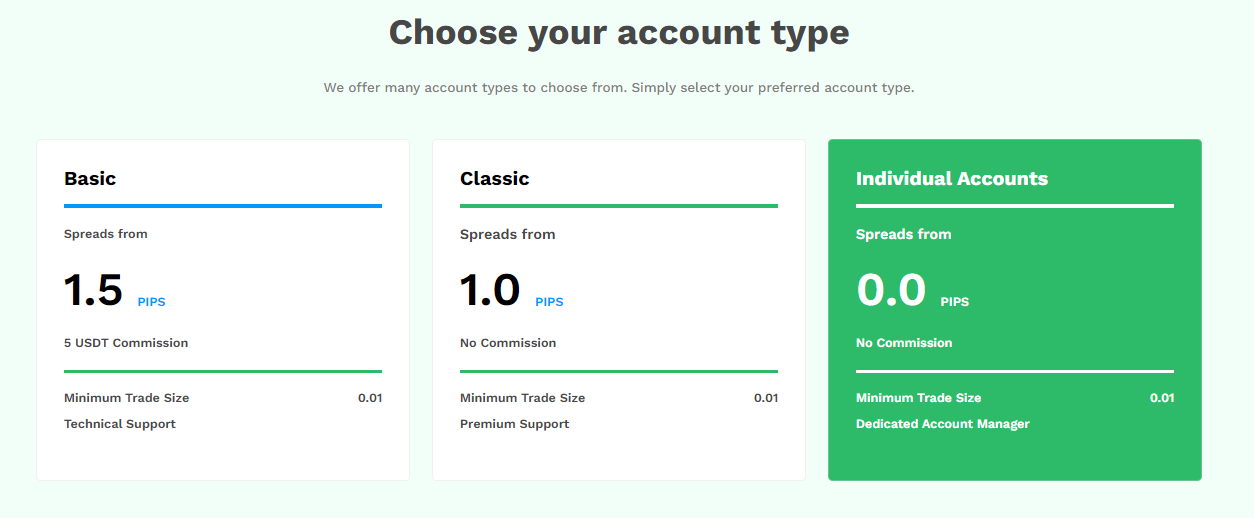

After you choose between Basic, Classic, or Individual, you’ll be asked to complete a secure application form. Since this is a regulated brand, it also has a KYC procedure in place, so you need to upload some documents.

Once the account is set, you can move on to deposit using a range of popular cryptocurrencies. With a funded account you are then free to trade any of the hundreds of CDIs available with Ex-Cap.

Max 1:200 leverage, spreads as low as 0.5 pips, automated trading, segregated accounts and personalized support are among the main account benefits.

Regulation

An important topic that needs to be discussed deals with regulatory compliance. Ex-cap.com is a registered trading name of Future Finance LLC, which is registered as a financial services company with the FSA under number 2294 LLC 2022. Additionally, the brand is a regulated international brokerage and clearing house by M.I.S.A under license number T2023327.

All of these show that Ex-Cap is heavily interested in operating by the law and for the benefit of its customers. It claims to have taken the necessary steps to create a friendly, secure and optimal trading environment.

Summary

Trading CDIs with Ex-Cap is accessible to anyone and thanks to the simple signup process, you can get started within minutes. In case you need more details about their offer, plenty of information is available at ex-cap.com. As we’ve mentioned, this is a regulated entity and transparency is part of their philosophy.

Ex-Cap Overview

Product Name: Ex-Cap

Product Description: Ex-Cap is an online brokerage specializing in crypto-denominated instruments. This brand claims that its customers can trade the world's largest markets with crypto without having to worry about conversion rates. With support for crypto deposits and withdrawals, it looks like the solution can be of great use for digital asset holders.

Brand: Ex-Cap

-

Trading Platform

-

Assets

-

Accounts

-

Customer Satisfaction

Summary

Trading CDIs with Ex-Cap is accessible to anyone and thanks to the simple signup process, you can get started within minutes. In case you need more details about their offer, plenty of information is available at ex-cap.com. As we’ve mentioned, this is a regulated entity and transparency is part of their philosophy.